Rick Dryer: About every other day I see some newspaper article that claims increasing interest rates will bring a bust to the real estate boom. These journalists seem to think an increase in interest rates automatically drives down property values. Tell me, Gary, you don’t agree with that view, do you?

Gary Eldred: As is par for the course, journalists who draw such conclusions don’t know what they’re talking about. In fact, when it comes to journalists, Rick, they often think they know things they don’t know and that makes them dangerous. Unwittingly, most journalists who write about finance and real estate mislead rather than enlighten.

Unwittingly, most journalists who write about finance and real estate mislead rather than enlighten.

Rick Dryer: Again, it’s not what you don’t know that hurts the most- rather it’s what you think you know that’s just not so. But let’s bring our readers up to speed – explain the actual relationship between interest rates and property values.

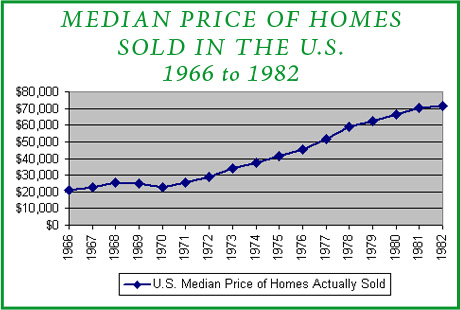

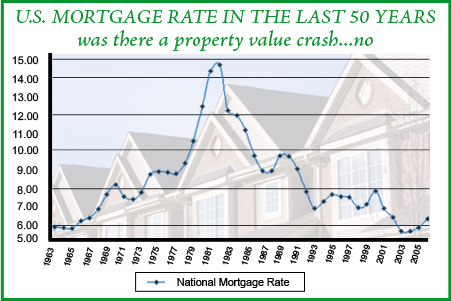

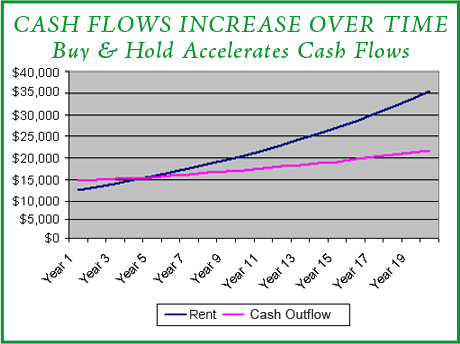

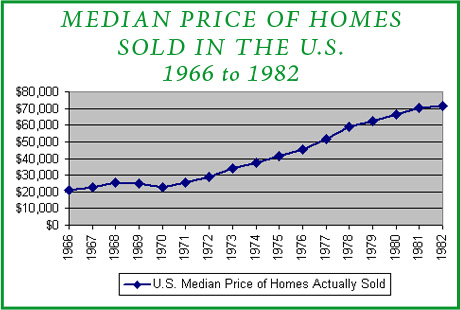

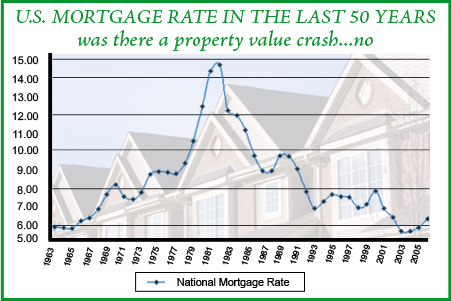

Gary Eldred: For starters, anyone who writes about interest rates and housing prices ought to at least review the historical record. Consider, for example, the 16-year period that extends from 1966 until 1982. During those years mortgage interest rates climbed from 6 percent up to 18 percent. Did property prices crash? No. In each and every successive year without pause or retreat the median home price edged higher.

Rick Dryer: (smiles) I’m much too young to remember the 1960s, but I do recall that my parents spoke of average houses then selling in the range of $20,000 to $30,000.

Gary Eldred: Right, which at the time seemed like an outrageous amount. Yet, by 1982—after that unprecedented skyrocketing of interest rates— typical homes sold for $65,000 to $90,000—depending on the specific area of the country.

Rick Dryer: Home prices nearly tripled.

Gary Eldred: Yes. As you have frequently mentioned, Rick, journalists tend to confuse the behavior of real estate prices with the up and down price swings of bonds.

Rick Dryer: No question about it. When long-term interest rates head up, bond prices head down—and vice versa.

Gary Eldred: So how does property differ from bonds?

Rick Dryer: When you buy a bond, the issuer promises to pay you a set amount each year as coupon interest and a set amount known as maturity value or face value when the bond falls due in, say, 10, 20, or 30 years. If current interest rates go up, bond investors will pay less for the right to receive those scheduled amounts of payments. With higher current market interest rates, investors will re-price outstanding bonds so that the payments they receive will return the now higher market yield.

Gary Eldred: Stated simply, if my $1,000 bond pays 5 percent in perpetuity (no maturity date), I can collect $50 interest per year. If market rates go to 10 percent, investors will pay just $500 for my bond. The investor who buys it will bid a price commensurate with a 10 percent return, i.e., 10 percent of $500 equals $50—the annual interest coupon amount that the bond issuer pays.

Rick Dryer: But property doesn’t behave like that at all, does it?

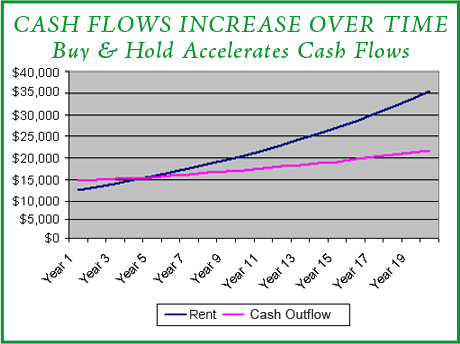

Gary Eldred: No—for a very good reason. Over time inflation pushes rents and property values up. Whereas, no matter how long you hold a typical bond, the issuer will pay the same amount of interest. If a $100,000, 30-year bond pays you $5,000 in interest in Year 1, it will still be paying $5,000 in interest in Year 30. (As long as the issuing company or government hasn’t defaulted or called the bond due—i.e., paid it off early because interest rates have fallen and the company can refinance its debt at a lower interest rate.)

Rick Dryer: I have never heard of a house that generates the same amount of rents today that it did 30 years ago. Have you?

Gary Eldred: Of course not. I just had a lease expire for one of my properties. I bumped the rent 20 percent and advertised it on Craig’s List at no cost. I had a signed lease from high-quality tenants two days later. That 20 percent increase was a stiffer boost than usual. But over the past 15 years, rents on that property have doubled. And I suspect that they will at least double again over the next 15 years.

Rick Dryer: How about value? Have you gained much appreciation?

Gary Eldred: That property’s value has tripled.

Rick Dryer: Right Place Right Time™ principles?

Gary Eldred: Absolutely.

CPI: Consumer Price Index - A measure of the average change in consumer prices over time of a fixed set of goods and services.

Rick Dryer: Are you worried that your properties will lose value if mortgage rates again climb to 8, 10, or say 12 percent?

Gary Eldred: Not at all. Mortgage rates increase in response to fears about inflation. If they go up and stay up for years—as interest rates did in the late 1960s until the early 1980s—it merely reflects steep advances in the CPI.

Rick Dryer: So higher long term interest rates only result from higher expected inflation, and higher inflation leads to higher rents and higher property values?

Gary Eldred: Yes. Granted, sharp spikes in mortgage interest rates can create a cyclical housing downturn, especially if unemployment jumps as the Fed tries to cool inflationary economic growth. But, as history shows, over a period of years, inflation—whether mild or heated—will push up construction costs. With higher costs to build, existing home prices are pushed up. More inflationary price gains, more investor wealth. (Remember, we typically borrow fixed rate money in periods of low interest rates and thus gain

from inflation due to constant payments and rapidly increasing equity.)

Rick Dryer: But Gary, I recently saw an article in Money Magazine that disputes your conclusions about inflation benefiting property owners.

Gary Eldred: More proof that journalists lack financial literacy.

Rick Dryer: The article said something like, “Homeowners overstate their returns from price increases because they don’t factor in their loss of purchasing power due to inflation. In other words, they count their appreciation gains but forget that their cost of living has also gone up at the same rate.”

Gary Eldred: Yes, I saw that article, too. The article merely parrots a passage from a book written by an economist who evidently knows nothing of financial leverage.

Rick Dryer: Money explains their argument something like this: “If you pay $100,000 for a house that over 10 years doubles in value, you’ve gained nothing if the CPI also doubled during that same decade. Rather than earning a big profit, you’ve really just been treading water.”

Gary Eldred: I only wish everybody believed that fallacy so I could go back to buying properties without so much intense investor competition.

Rick Dryer: You want to reveal the fallacy or should I?

Gary Eldred: Please, you do the honors.

Rick Dryer: The Money Magazine economist ignored the fact that we buy our properties with just a 10 or 20 percent down payment. For purposes of example, say I bought that $100,000 property with a down payment of $20,000. Assume that during those 10 years I paid down my mortgage balance (from rent collections) to $60,000.

Gary Eldred: At Year 10 your equity has grown to $140,000—seven times the amount you started with.

Rick Dryer: I see that you are good with numbers. Can you tell me my real gain?

Gary Eldred: If the CPI doubled, we would cut your nominal gain of $140,000 in half. So in real terms you’ve multiplied your purchasing power 3-1/2 times—from $20,000 to $70,000.

Rick Dryer: Let me punch out some numbers on my calculator. In terms of percentage gain I earned a real (inflation adjusted) annual rate of return of around 14.2 percent. Beats any low-risk (or for that matter, high risk) investment that I know of.

Gary Eldred: As a rule, Right-Place Right-Time properties experience price gains at a rate that exceeds the growth in the cost of living. Their prices advance for reasons of both inflation and heightened demand.I think Money Magazine needs to publish a correction and an apology for their readers. But that’ll be the day. Do you think they want to lose all of those advertising dollars that the mutual funds and the stock brokerage firms throw at them?

IRR (Internal Rate of Return):

The discount rate that equates the net present value (NPV) of an investment's cash inflows with its cash outflows

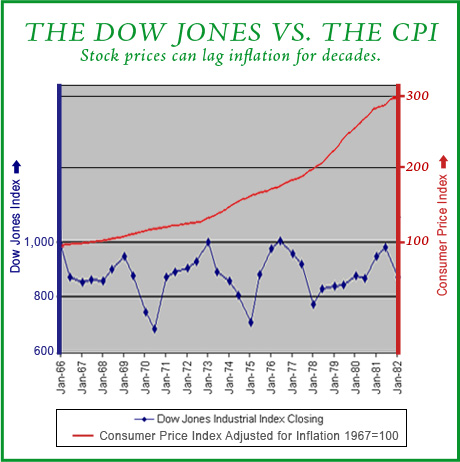

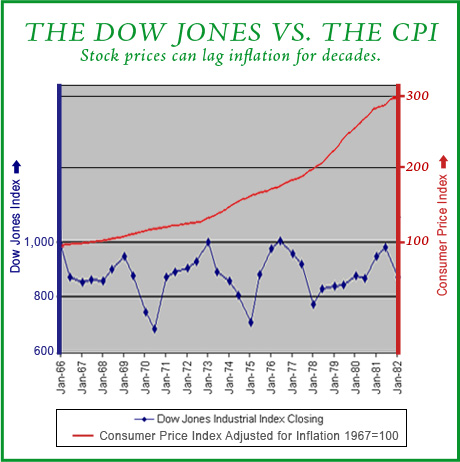

Rick Dryer: (laughs) Maybe its just an industry specific myopia all industries suffer, and not an evil quid pro quo. But without considering leveraging, any ROI or IRR analysis is silly. Gary, your mention of stocks and mutual funds prompts me to ask another question. We’ve seen that during periods of high inflation, interest rates go up, rents and property prices go up, and bond prices go down. What happens to stocks?

Gary Eldred: When I was in graduate school during the 1970s, every finance professor lectured us that “during periods of high inflation, dump bonds, buy stocks.”

Rick Dryer: That’s the same story I hear today. “Invest in stocks for retirement. They’ll protect you against inflation.”

Gary Eldred: Do you know what history shows?

Rick Dryer: Yes, just the opposite. In 1966 the Dow Jones Industrial Index touched 1,000 for the first time. The Dow was then setting record highs as were property prices. Thereafter, as properties continued their climb to new price records, stock prices merely bounced up and down. The Dow never could not sustain that 1,000 mark until after 1982—and along the way the Dow fell to below 600—a more than 40% decline.

In periods of rising interest rates, inflation boosts my property values and multiplies my leveraged equity.

Gary Eldred: I would like to clarify that we’re talking averages. No matter what kind of stock market, property market, bond market,* or economic climate we’re experiencing, some individual investments among any asset class will move contrary to the trend.

Rick Dryer: That’s true. In terms of probabilities, though, I’m sticking with well-selected properties. In periods of rising interest rates, inflation boosts my property values and multiplies my leveraged equity. In periods of declining interest rates, heightened demand boosts my property values and multiplies my leveraged equity. As a bonus, when interest rates fall, I get to refinance, lower my monthly mortgage payments, and increase my cash flows.

Gary Eldred: I agree. With property, whether interest rates head up or interest rates slide down—over the longer run, either way—You win.

Rick Dryer: Critics will say that our advocacy of real estate investing just reveals our industry specific myopia. But I hardly think so. The facts of history support our conclusions, calculations, and forecasts. People are smart enough to decide for themselves. They can read your books, maybe take the Trump University courses you’ve designed, study my Right Place Right Time™ Real Estate Investment Strategies. Then they can make their own well reasoned choices.

Gary Eldred: (smiles) Amen to that!

<Previous Dialogue | Click Here to Register for Future Dialogues

|