Gary Eldred: Rick, we often talk about the best way to invest in real estate for most people. I suspect that “buying at a bargain price” ranks as one of the top goals for

many beginning investors. In fact, nearly all of the real estate gurus promote this idea.

Rick Dryer: I’m with you, bargain price reigns as the fantasy unicorn or Pegasus of the dreamers and the wishers. Real estate realists look for thoroughbreds instead. Unfortunately, the traditional view of looking for bargains seems akin to panning for gold in the Mississippi River. You’re more likely to drown than get rich.

Gary Eldred: But Rick, the large majority of real estate gurus— many of them our friends in fact, but some that certainly are not, and some of whom give wonderfully entertaining presentations—preach the gospel of bargain prices. Indeed, most authors of books written on the topic of real estate investing tell the same story. “Only buy properties for less than they are worth.” Rick, do you agree?

Rick Dryer: Absolutely. 100 percent! I always like to buy properties for less than they’re worth. However, I advocate an investment strategy that differs from the hype and hucksterism that champion techniques that do not and cannot work for the great majority of people. Whereas the gurus typically focus on past market values, my approach looks to the future. The gurus tell people to dig through tons of rubble to search for an ounce of gold.. Instead, through my Right Place Right Time™ principles, I urge investors to locate those geographic areas of the country that are likely to experience rates of appreciation that will exceed the averages by 50% to 100%.

Gary Eldred: When you refer to guru touted techniques, do you mean techniques such as motivated sellers, foreclosures, pre-foreclosures, flipping fixer uppers, probate, and REOs? Those techniques dominate real estate seminars, boot camps, books, tapes, and CDs.

Rick Dryer: Yes. Much of this stuff is downright silly. Success is about as likely as finding the Hope diamond in your backyard. Serious investors know that most motivated sellers are unable or unwilling to sign over a property for 60 cents or 70 cents on the dollar.

Gary Eldred: Refresh my memory. Those aren’t the techniques you use? They sound good to me. I would sure like to buy at a 30 or 40 percent discount from market value.

If such a strategy could reliably create multimillionaires out of “no-cash no-credit no-problem” investors...why in all of our combined years of experience have we never met one such millionaire?

Rick Dryer: Gary, just think about it. If I could easily find and negotiate such deals, I certainly would, but you’ve been dealing in real estate for several decades. How often have you found sellers of any stripe who will part with their properties for 60 cents or 70 cents on the dollar? And if such a strategy could reliably create multimillionaires out of “no-cash no-credit no-problem” investors—as many books and tapes promise—why in our combined 50 years of experience have we never met one such millionaire? And here’s another question, I have read your books. I don’t recall you strongly advocating such techniques. Why not?

Gary Eldred: Wow! You’ve fired a lot of queries in my direction.

Rick Dryer: Yes, but I’m sure you know the answers because we’ve discussed these issues many times.

Gary Eldred: That we have. So why don’t you bring our audience up to speed.

Rick Dryer: In the first place, Gary, we both recognize that few sellers whom the law deems legally competent will give such a bargain. Why would they? If they owned a large equity position in the property and needed fast money, they could do a cash-out refi. If their credit were bad, they could use a hard money lender. Even hard money costs less than selling at a give-away price. Or to sell quickly, those desparate owners could auction the property. More than likely, bidders would drive the price up close to market value.

Gary Eldred: What if the owners have failed to accumulate much equity in their property?. Instead, they are up to their eyebrows in mortgage debt.

Rick Dryer: In that case they sellers can’t steeply discount the price. To convey clear title they will need to net a price high enough to pay off their lenders and any other liens that may encumber title.

Gary Eldred: What about a short sale?

Rick Dryer: You mean convince the lender to release its lien in exchange for a short payoff; that is, get the lender to clear its lien at a discount?

Gary Eldred: Right.

Rick Dryer: I’ve seen it happen, but even in distressed markets, lenders resist taking less than they are owed. Once word spreads that debtors could skate on their mortgage payments, lenders would have to fight off the crowds of borrowers or investors who would like to get a piece of that action.

Gary Eldred: That’s certainly my experience. In the real world, to make a short sale happen, you’ve got to prepare a detailed written proposal that shows how the bank will actually gain by losing less than the foreclosure option would cost them.

Rick Dryer: You also have to prove that the current borrowers lack any means to pay back what they owe—either now or in the foreseeable future.

That’s the big urban legend.

Why pay retail when you can buy wholesale? ...neither real estate newbies nor pros can easily score real bargains with a preforeclosure purchase.

.

Gary Eldred: If desparate, motivated sellers don’t offer the fast and easy profits that the gurus promise, what about the foreclosure sale itself? Many of the gurus claim that they can teach their students how to buy foreclosures for “pennies on the dollar.” In fact, one infomercial is running right now. The supposed guru holds up color photos of nice-looking houses and then promises to show how anyone can buy similar properties for at most a few thousand dollars.

Rick Dryer: Gary, you’re a runner. Tell me, how many miles have you covered during the past 20 years.

Gary Eldred: What?

Rick Dryer: How many miles have you run?

Gary Eldred: About 2,000 a year. Over the past 20 years—give or take—40,000 miles. Are we still talking about real estate?

Rick Dryer: Stay with me. In covering all of those miles over all of those years, how many times have you found a $100 bill lying on the ground in front of you?

Gary Eldred: A $100 bill? Never.

Rick Dryer: A $50 bill?

Gary Eldred: No.

Rick Dryer: A $20 or $10 bill?

Gary Eldred: No. But I once picked up a Timex watch. It worked for years afterwards. I thought that find was pretty lucky.

Rick Dryer: It takes a licking and keeps on ticking? Kind of like you and me? But to get back to my point, you agree that rarely does anyone find money (or other items of value) just lying around unclaimed?

Gary Eldred: That’s certainly my experience.

Rick Dryer: Then, how is it that “fresh out of bootcamp” real estate newbies can show up at a foreclosure or tax deed sale and buy a property for pennies on the dollar or even 30 or 40 percent below market value? Don’t the thousands of people in every city who earn their living in real estate —sales agents, appraisers, real estate lawyers, loan reps, contractors, professional investors such as you and me—snap up these bargains?

Gary Eldred: That’s the big urban legend. Why pay retail when you can buy wholesale? The truth is that neither newbies nor pros in the business can easily score bargains at a foreclosure sale. Most of the properties that are auctioned at foreclosure are bought by a lender who holds a mortgage against the property. If a property does sell at a discounted price, the buyer bets that he can clear up title issues, avoid costly hidden property defects, renovate, and resell at a profit. If the investor wins, he does so by taking on risk, work, and market study.

Rick Dryer: That’s the point I’m making. You will find easy profits at a foreclosure sale about as often as you will find $20 bills lying on the sidewalk. Virtually anyone who knows about either will quickly snap it up.

Gary Eldred: I wish it weren’t so, but I’m afraid it is. Nevertheless, that still leaves us with REOs. If at the foreclosure sale, the mortgage lender wins the bid for the property, won’t that lender be willing to sell it cheaply just to get the property off its books? Lenders want to loan—not own. Right?

Rick Dryer: True, lenders don’t want to hold onto their foreclosed properties. But over the years lenders have become much more savvy about selling their REOs. Practices differ today. Twenty or thirty years ago most foreclosed properties were owned by local banks and savings and loans. Back then, you often could pick up good deals from these lenders—especially if you had local bank connections.

Gary Eldred: Now though, Freddie Mac, Fannie Mae, FHA, and VA own most of the 1-4 family foreclosures.

Rick Dryer: Yes, and none of these big players like to give their properties away. Same with IRS seizures. The IRS, Fannie, and Freddie nearly always fix up their properties and then market them at fair value through MLS or widely-publicized auctions. And FHA sells through a bid process that favors homebuyers and severely restricts investors. Similarly, the VA normally tries to get full value for its properties.

Gary Eldred: You don’t think I can persuade any of these big mortgage players to sell me one of their REOs for even 20 percent below market value?

Rick Dryer: If you figure out an approach that succeeds, please let me know.

Times have changed. Today, Freddie Mac, Fannie Mae, FHA, and VA own most of the 1-4 family foreclosures.

Gary Eldred: What about the remaining local banks, credit unions, and savings associations? Many of these mortgage lenders still hold their loans and do not sell them into the secondary mortgage market.

Rick Dryer: If I were going to try to score an REO bargain, that’s where I would look, but even the smaller lenders have wised up—especially during these past bull market years. Such a large number of wannabe investors have been ringing the phones of these lenders’ loss mitigation departments that to get rid of any property that’s worth buying, they no longer need to steeply discount price.

Gary Eldred: And you usually need connections and patience?

Rick Dryer: Connections, patience, money, and credit.

Gary Eldred: Okay, Rick, you shot down my hopes to easily snag a deeply discounted bargain from motivated sellers, foreclosures, probate, IRS or REOs. Tell me, how can investors best find properties to buy for less than they are worth?

Rick Dryer: Easy. Change what they’re looking for. Don’t think that bargain price relates only to current market value. More importantly, it relates to future value. That’s a winning strategy. That’s acquiring a thoroughbred when it’s a colt, not scurrying about trying to buy a winner of the Kentucky Derby for half of what it’s worth.

Gary Eldred: Give me an example of what you mean.

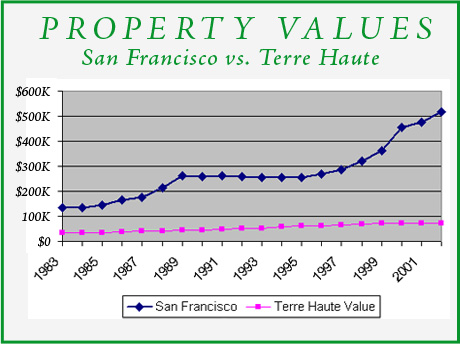

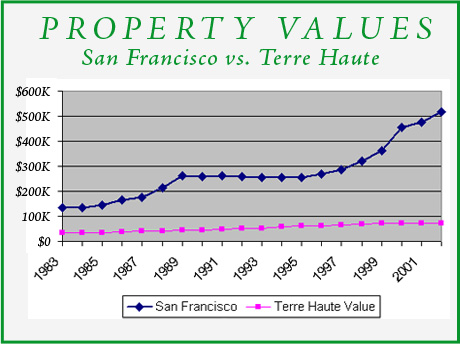

Rick Dryer: Assume that 20-25 years ago you bought a property in California for its market value of $100,000. Today that property is probably worth $400,000 to $500,000. If you bought that property with a 10% down payment, your equity has increased by a multiple of 40 or 50. Now, assume that 20 years ago you found a property in Terre Haute valued at $100,000. Through your brilliant negotiating skills, you stole that Terre Haute property for $75,000. Tell me, how much would that property be worth today?

Gary Eldred: Probably $150,000, $175,000 tops.

Rick Dryer: So which property proved to be the best bargain? The below-market buy in Terre Haute? Or the market value buy in California?

Gary Eldred: I don’t even have to pull out my calculator to answer that one. I’ve made around $400,000 (or more) in California versus $150,00 or so in Terre Haute.

Rick Dryer: Now you see the logic of my approach. Why waste huge quantities of time chasing after those tough-to-come-by below-market deals? Why not discover the areas where properties are most likely to appreciate the fastest during the coming 5, 10, or 20 years?

Gary Eldred: You’ve convinced me. Right Place, Right Time™. The prices investors pay today should look like terrific bargains 5, 10, or 20 years from now--if they choose the most promising areas.

Rick Dryer: In fact, Gary, I know that you’ve urged readers of your books to think of “bargain” in exactly the same way. I recall that way back in 1996 your book, Stop Renting Now, you advised, “By 2005, those renters in California who fail to buy will forever regret the bargains they passed up today.” You weren’t talking about foreclosures and motivated sellers. You were referring to the fact that California then displayed all of the up indicators that would permit you to safely forecast strong appreciation over the coming decade—even though nearly all journalists (and the economists they quote) were telling Californians that “real estate was no longer a good investment.”

Gary Eldred: Exactly. Now that you’ve reminded me to think back, I recall a passage in Robert Kiyosaki’s book, Rich Dad, Poor Dad. Since you know Robert, and have shared the stage with him on numerous occasions, you might also remember his stunted traditional way of thinking about bargain prices. During the early 1990s, he had been scouting for foreclosures in Phoenix, but by 1996 he wrote that “bargains in Phoenix were getting tougher and tougher to find.”

Rick Dryer: In fact, though just like California, Phoenix in the mid-1990’s was awash in up socio-economic indicators. Relative to the much higher prices today, nearly every property back then represented a bargain.

To invest with savvy, envision the future. Look forward, not backwards.

Gary Eldred: Unfortunately, because the vast majority of investors have been taught to measure a bargain price relative only to a property’s current market value, they regularly pass up the real bargain of owning that property in the future.

Rick Dryer:Absolutely, to invest with savvy, envision the future. Look for emerging trend lines and sources of favorable change. As we’ve noted, pay special attention to demographic and economic growth.

Gary Eldred: Let’s explore these “up (or down) indicators” in more detail in later conversations.

Rick Dryer: Good suggestion.

<Previous Dialogue | Next Dialogue>

|