Rick Dryer: Gary, I know you know the most powerful word in the English language, don’t you?

Gary Eldred: That I do. It’s leverage. No matter if you’re trying to pry open a window, move a boulder, negotiate a $10 million deal, operate a Fortune 500 company, run the bureaucracy of the Catholic Church, or maximize the return on your investment, leverage creates the muscle, the power to accomplish your goal.

Rick Dryer: (laughs) “The bureaucracy of the Catholic Church?” Anyway, you’re right. Through leverage you can magnify and multiply the effects of your efforts. As to real estate, leverage  gives property investors the ability to control a highly valued asset with a relatively small amount of their own cash. That’s why the open bank vault aspect of real estate ownership becomes so important. Those bankers and other mortgage lenders are kind enough to offer real estate investors lots of money with favorable costs and terms. We can own (or control) properties that cost five to ten times more than the cash that comes out of our own pocket. gives property investors the ability to control a highly valued asset with a relatively small amount of their own cash. That’s why the open bank vault aspect of real estate ownership becomes so important. Those bankers and other mortgage lenders are kind enough to offer real estate investors lots of money with favorable costs and terms. We can own (or control) properties that cost five to ten times more than the cash that comes out of our own pocket.

Gary Eldred: Strange as it seems, the great majority of financial journalists fail to grasp the meaning of this elementary idea. That’s why these journalists have the temerity to compare unleveraged real estate returns instead of actual ROI to other investment opportunities, and draw the wrong conclusions.

Rick Dryer: Absolutely! You’ve pointed out many times that even when so-called experts compare the investment performance of stocks, bonds, money market funds, etc., to property, they routinely omit the critical role that leverage plays for property investors in magnifying their ROI (return on investment).

Gary Eldred: You see this all the time. Money Magazine, Smart Money, Kiplinger’s—all of those financial magazines that cater to their Wall Street advertisers — focus on the appreciation rates of various asset classes. Over the years I have seen hundreds of articles that say something like, “Stocks up eight percent last year. Homes lagged with just a four percent gain.” But it’s the gain relative to the controlling investment that yields the true ROI. Real estate, as we’ve discussed, allows the average purchaser to use 8 or 9 dollars of the capital markets for every one or two of his or hers. That means the real estate ROI is 40 or 50 percent, not four percent. Gary Eldred: You see this all the time. Money Magazine, Smart Money, Kiplinger’s—all of those financial magazines that cater to their Wall Street advertisers — focus on the appreciation rates of various asset classes. Over the years I have seen hundreds of articles that say something like, “Stocks up eight percent last year. Homes lagged with just a four percent gain.” But it’s the gain relative to the controlling investment that yields the true ROI. Real estate, as we’ve discussed, allows the average purchaser to use 8 or 9 dollars of the capital markets for every one or two of his or hers. That means the real estate ROI is 40 or 50 percent, not four percent.

They just don’t get it. Or following the lead of a bestselling book written by a finance professor, such articles parrot the idea that, “over the long run, stocks outperform all other types of investments.” They are not looking at ROI.

Rick Dryer: You know what’s sadly funny? I read that book and the author does not even include property in his comparisons. He only calculated returns for stocks, bonds, and Treasury bills.

Gary Eldred: Thanks Rick. Your point further supports my complaint that most financial journalists display some unflattering combination of intellectual dishonesty and incompetence.

Real estate...allows the average purchaser to use 8 or 9 dollars...for every one or two of his or hers.

Rick Dryer: (laughs) I’d rather believe they just need to read a couple of your best selling books, Gary. But until they do, unfortunately, too many of their readers don’t recognize these writings for what they are.

Gary Eldred: I don’t want to stray too far from our topic - the explanation of why and how leverage rewards property investors with outsized returns with comparatively minimal risk. But, I do think it useful to warn our readers not to blindly accept the financial pornography that passes all too easily for words of wisdom.

Rick Dryer: I agree. One of my favorite quotations (often attributed to the great humorist Will Rogers) goes something like this, “Fear not things you don’t know, rather, fear most the things you think you know that just ain’t so.”

Gary Eldred: Great quote. I’m writing that down.

Rick Dryer: In getting back to the rewards of real estate, you were raised in the city of Terre Haute, Indiana, on the banks of the Wabash. As you have told me, Terre Haute may be a wonderful place to live for some people, but it certainly hasn’t led the country in terms of the Right Place, Right Time up indicators that savvy property investors look for.

If we calculate their return from appreciation, we see their equity really grew from $500 into $74,000.

Gary Eldred: No it hasn’t. It does, though, lead in the number of potholes and railroad tracks!

Rick Dryer: Potholes and railroad tracks are down indicators, unfortunately. But seriously for the lessons to be learned, how have property investors fared in Terre Haute?

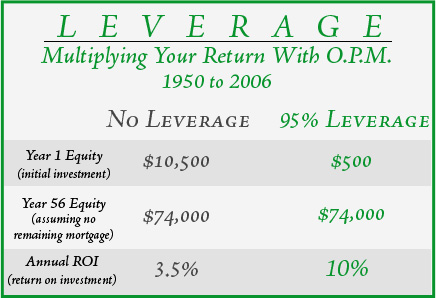

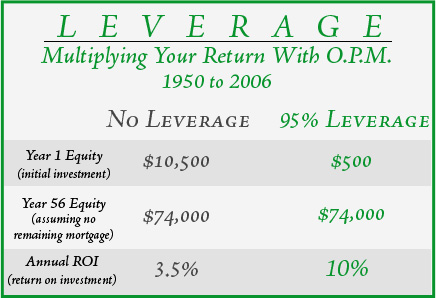

Gary Eldred: Well, according to the appreciation contests among cities that the media likes to report on—not too well. This past summer we sold my parents’ home of 56 years at a price of around $74,000. My parents had purchased the house in 1950 at a price of about $10,000. Based on these figures, the media would say my parents earned a lousy 3.5 percent a year on their investment.

Rick Dryer: Did your parents pay cash for their house?

Gary Eldred: Hardly. I think my father bought it with a VA loan and $500 down.

Rick Dryer: So, your dad used leverage. The bank opened its vault to help your parents buy their home.

Gary Eldred: Right. If we calculate their return from appreciation, we see their equity really grew from $500 into $74,000. Rather than experiencing a modest percentage of 3.5 percent a year, their true rate of return from the growth of their cash investment was just under 10 percent. Their real return was three times greater than the raw rate of appreciation.

Rick Dryer: That clearly shows the power of leverage – and how to accurately figure a ROI, and how dramatically the numbers change when accurately analyzed.

Gary Eldred: Now, Rick, I think we both agree that if we had applied the Right Place, Right Time Real Estate Investment Strategies™ indicators to Terre Haute—even back in 1950—we would have declined to invest there. Other cities and regions of the country would have looked far more promising. And, in fact, many other areas have proved far superior. Nevertheless, even property investors in Terre Haute (who used leverage) could easily have outperformed the stock market in terms of value increases.

In 1950, the Dow Jones Index stood at 250. Today, the DJI stands around 12,000. Whereas my parents saw their cash investment multiply nearly 150 times over, during this same period, investors in the stock market gained less than a 50-fold gain —and that 50- fold multiplier occurred over the longest secular bull market run in history. Even

stock market enthusiasts such as “stocks for the long run” author, Jeremy Siegel, do not

forecast those types of above normal returns during the decades to come—especially when one considers the fact that retiring baby boomers will soon become net sellers of stocks.

Rick Dryer: I would like to highlight your point which makes our larger point. Here we have a city that’s shown virtually no population growth, a vast loss of good paying jobs, and a climate that most people would like to move away from—yet long-term property owners still managed to multiply their equity 100, 150, even 200 times over.

Gary Eldred: That’s right. Real estate is so powerful, it even works in Terre Haute.

Rick Dryer: Of course, your critics would challenge you because you’ve not really accounted for all of those mortgage payments, property taxes, insurance premiums, and maintenance expenses that property owners had to bear during those years of ownership.

Gary Eldred: You’re toying with me, Rick. You know that your Right Place, Right Time principles emphasize cash-flows (in the case of investors) and housing benefits (as in the case of my parents and other homeowners). These yearly expenses are more than offset by the rents collected from tenants or the “roof over their head” enjoyed by homeowners.

These yearly expenses are more than offset by the rents collected from tenants or the “roof over their head” enjoyed by homeowners.

Rick Dryer: Gary, you’ve shown that even in an economically stagnant town, long-term property owners can earn an attractive return that rivals or exceeds the stock market. I’d like to show how leverage works wonders over a shorter term in an area that’s poised for growth.

Gary Eldred: Yes, I got a little carried away with my Terre Haute story.

Rick Dryer: Not really. You’ve made an extremely important point that’s based on real life. But knowing how to apply Right Place, Right Time principles can certainly boost the returns that leverage creates.

Gary Eldred: I’m listening.

Rick Dryer: Say, for example, you buy a well-selected property for $200,000. You put $20,000 down. Over 12 years, the property doubles in value (a mere 6 percent annual rate of appreciation will do that). That appreciation alone has multiplied your original cash investment fivefold. Your $20,000 has grown into a $100,000 gain.

Gary , you know that you and I always warn that when investing, nothing is certain. You’ve got to play the probabilities. So, let me ask you a question. Where do the probabilities lie? That a well-selected house will typically appreciate 6 percent a year? Or, that during the next 12 years, the Dow Jones stock market index will jump from around 12,000 today to 60,000?

Gary Eldred: When you put it in those terms, Rick, I suspect that even a financial planner who sells mutual funds would have to admit that property offers the best probability for a fivefold gain over a dozen years. Let’s thank those bankers who keep their vaults open to real estate investors. But they wouldn’t do it unless they agreed that real estate typically provides a secure reservoir of value. Although journalists and Wall Streeters persistently miss this point, we’re lucky the mortgage bankers get it!

|

gives property investors the ability to control a highly valued asset with a relatively small amount of their own cash. That’s why the open bank vault aspect of real estate ownership becomes so important. Those bankers and other mortgage lenders are kind enough to offer real estate investors lots of money with favorable costs and terms. We can own (or control) properties that cost five to ten times more than the cash that comes out of our own pocket.

gives property investors the ability to control a highly valued asset with a relatively small amount of their own cash. That’s why the open bank vault aspect of real estate ownership becomes so important. Those bankers and other mortgage lenders are kind enough to offer real estate investors lots of money with favorable costs and terms. We can own (or control) properties that cost five to ten times more than the cash that comes out of our own pocket.  Gary Eldred: You see this all the time. Money Magazine, Smart Money, Kiplinger’s—all of those financial magazines that cater to their Wall Street advertisers — focus on the appreciation rates of various asset classes. Over the years I have seen hundreds of articles that say something like, “Stocks up eight percent last year. Homes lagged with just a four percent gain.” But it’s the gain relative to the controlling investment that yields the true ROI. Real estate, as we’ve discussed, allows the average purchaser to use 8 or 9 dollars of the capital markets for every one or two of his or hers. That means the real estate ROI is 40 or 50 percent, not four percent.

Gary Eldred: You see this all the time. Money Magazine, Smart Money, Kiplinger’s—all of those financial magazines that cater to their Wall Street advertisers — focus on the appreciation rates of various asset classes. Over the years I have seen hundreds of articles that say something like, “Stocks up eight percent last year. Homes lagged with just a four percent gain.” But it’s the gain relative to the controlling investment that yields the true ROI. Real estate, as we’ve discussed, allows the average purchaser to use 8 or 9 dollars of the capital markets for every one or two of his or hers. That means the real estate ROI is 40 or 50 percent, not four percent.