Gary Eldred: You know, Rick, it seems like every time I pick up a copy of the Wall Street Journal, Money Magazine, Smart Money, or some similar publication, I see articles touting the tax benefits of 401(k)s, 403(b)s, IRAs, and other tax-deferred investment plans. Yet, I rarely, if ever, see these types of publications educate the investing public about the great tax benefits of real estate—even when it’s owned personally (or through an LLC) and not held in a formally designated retirement plan.

Your ultimate goal is to maximize your wealth...Your goal is not to save taxes per se. It’s the total after-tax rate of return that counts.

Rick Dryer: Do you notice the advertisements in those publications? Mutual funds, hedge funds, stock brokers, life insurers, money managers. Nearly everyone who profits from the Wall Street money machine.

Gary Eldred: Don’t bite the hand that feeds you, right?

Rick Dryer: Maybe it’s just industry specific myopia, but I’d say, you’ve nailed it.

Gary Eldred: So, it’s up to us to reveal the real nature of those so-called tax-favored stock-based investment plans.

Rick Dryer: Real estate gurus to the rescue! The Wall Streeter’s may accuse us of our industry specific myopia, as well, but I think we can fairly address the issues. Our readers decide. Though, first, I’d like to make a critical point. In the hot pursuit to save taxes, the basic goal often gets overlooked. Ultimately, your goal is to maximize wealth—to earn the largest possible risk-adjusted, after-tax rate of return. Your goal is not to save taxes per se. It’s the total after-tax rate of return that counts.

Gary Eldred: Spoken like a true Democrat. Just kidding, Rick. In fact, you’re absolutely correct. I would rather earn 20 percent (or more) on my property investments and pay full taxes than earn 10 percent on stocks tax-free.

Fortunately, that’s not the choice we have to make. Property investors not only earn higher rates of return. When they’re tax savvy, they can also fend off the IRS.

Rick Dryer: In fact, it’s not at all certain that investors who set up 401(k)s, 403(b)s, and IRAs will actually pay less taxes.

Gary Eldred: What do you mean?

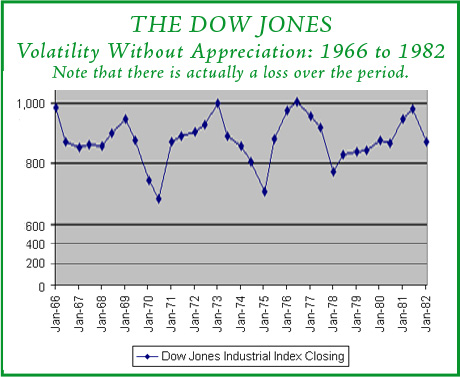

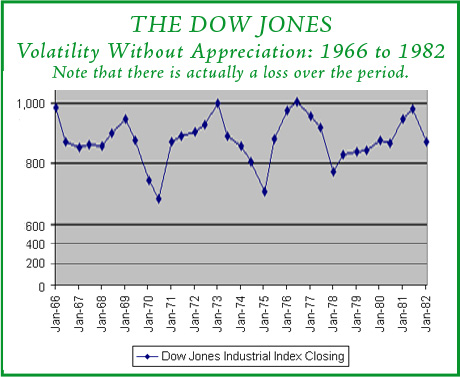

Rick Dryer: You’ve often talked about the puny income yield on stocks. Right?

Gary Eldred: Right. The S&P 500 currently pays a dividend yield of around 1.8 percent.

Rick Dryer: Given this puny dividend yield, stock market investors must expect to earn most of their return through capital gains. Now, let’s say their dreams come true. The stock market gets onto a steady upward path. They accumulate $1 million in their 401(k).

Gary Eldred: Up to this point, they’ve paid no income taxes on their accumulations.. Looks pretty good.

Rick Dryer: But here’s the catch. The IRS will tax every dollar these investors withdraw as ordinary income.

Gary Eldred: Usually tax savvy investors try to take their profits as capital gains.

Rick Dryer: That’s the rub. These investors have done the opposite. Their supposedly tax-favored retirement plan forces them to pay the high ordinary income tax rates on their gains—even though most of those gains accrued through portfolio appreciation. Holding assets in a tax-deferred plan means whatever the source of profit, dividends or capital gains, when eventually withdrawn,the money is taxed as ordinary income! People look at the tax free accumulation within the plan and forget the tax due on distribution.

Gary Eldred: They also could get hurt in the future by higher tax rates. With budget deficits piling up and the Democrats again in the Congressional majority, the federal government more than likely will raise taxes..

Rick Dryer: These folks face another big risk, too. At current dividend yields of 1.8 percent, that $1 million will throw off just $18,000 a year. After paying income taxes, maybe $13,000 or $14,000 remains. To climb out of poverty , these investors will have to eat their nest egg.

Gary Eldred: How fast?

Rick Dryer: That’s the problem. They don’t know how long they’re going to live. They don’t know how much they can safely withdraw each year. The wonderful advances in medicine and life expectancy of well cared for folks can wreak havoc in retirement planning. To live comfortably throughout two or three decades of retirement, we all are going to need a lot more income and wealth than most people now realize.

Gary Eldred: I hate to sound pessimistic, but what if the stock market dives into a tailspin—as it does from time to time? Less nest egg. Lower dividends, In turn, to maintain their living standards, they need to take bigger bites out of their nest egg.

Rick Dryer: You’re making my point. Millions of Americans are told to put as much cash as the law allows into their tax-deferred stock-based retirement plans. They are not being told that such plans are unlikely to provide the after-tax income and security these retired investors will need to achieve financial freedom, to retain wealth without worry.

Gary Eldred:The “tax-favored” lure baits the hook.

Rick Dryer: Absolutely. Convinced that they are “saving taxes,” they don’t think through the total risks and returns that they will likely encounter.

Gary Eldred: Rick, let’s now spotlight how investors can use property to pay little or no taxes, earn higher returns, and face less risk.

Rick Dryer: To keep it short, we won’t go into all of the nooks and crannies.

Gary Eldred: Good idea. We can explore details later. Rick, why don’t you start with depreciation? Tell readers why property investors love depreciation.

Rick Dryer: After celebrating the wealth-building power of appreciation, it might seem contradictory to say we love depreciation. But here’s the distinction. In the real world, properties generally go up in value. In the accounting world of the IRS, properties depreciate.

So, each year the IRS lets residential property investors deduct 3.6 percent of the property’s value (less land value). If a rental house (exclusive of its land value) costs you $100,000, the IRS gives you an automatic yearly tax deduction of $3,600. You didn’t have to write a check. You didn’t have to actually pay anybody anything. The law entitles you to take this tax deduction.

[If] you own multiple houses with a total value of $1,000,000... You could simply live on the inflation-protected cash flow of $60,000 to $70,000 a year... That amount of income flow certainly beats the income yield from stocks.

Gary Eldred: Here’s a specific example. Say you put $20,000 down on this rental house. After collecting your first year rents and paying your cash outlays, you’re left with $3,000. You put that $3,000 into your bank account tax free. Your (noncash) IRS deduction of $3,600 for depreciation more than offsets your net cash rental income.

Rick Dryer: Okay, now seven years have passed, assume that you’ve paid down your mortgage, your property has appreciated, through a combination of value increases and paying down your mortgage, you’ve built up equity in the property of $100,000. You’re itching to use that equity to acquire a more expensive property.

Not a problem. Section 1031 of the IRC permits you to sell your current property and use all of the proceeds tax-free to move up the property ladder. You can repeat this tax-free, trade-up strategy as many times as you wish. As long as investors follow the procedure laid out by the law, the IRS won’t tax their gains.

Gary Eldred: The years have gone by. You now own multiple houses with a total value of $1,000,000. You want to reap the fruit of your investment. You could simply live on the inflation-protected cash flow of $60,000 to $70,000 a year (based on currently available yields). That amount of income flow certainly beats the income yield from stocks. Plus, you are also still earning the appreciation on the property.

Rick Dryer: Or if you prefer a pile of tax-free cash, re-mortgage the properties for a total of $700,000 or $800,000 (70% to 80% LTV). The IRS won’t touch that cash the bank lends you. Then let your tenants once again repay your mortgages. Plus, few people know that if you want to draw social security at age 62 (or at any other time before reaching your full retirement age), your rent collections won’t cause you to lose benefits due to the SSA earnings test. However, if you draw out money from a traditional 401(k) or 403(b) plan, social security will slice your monthly checks.

Gary Eldred: With real estate you enjoy the best of many worlds. You can use depreciation to shelter your income. You can take your money and keep the asset. No nest egg problem, no tax on cash out refinances, no earnings test for social security, and no real fear that your well-selected property portfolio will crash in value. In addition, something else we have not mentioned, Rick, as you know, when you leave this world, your heirs will not have to pay any income tax on the gains in value your properties have accumulated. They inherit your properties with a stepped up tax basis. That same rule does not apply to the money your heirs inherit from any remaining balances in your traditional so-called tax-favored retirement plans.

Rick Dryer: Please note, we are not giving tax advice. Everyone needs to talk to their own CPA about their own circumstances and any limitations as to them of these tax benefits, but our accountants prove to us every year how substantially and beneficially tax obligations are affected through real estate ownership. So, will you excuse me for a while, Gary? I’m going out to buy another property.

Gary Eldred: I think I’ll go with you.

|