Gary Eldred: Rick, you often say—and I strongly agree—that wealth building with property comes largely from appreciation. That’s why your Right Place, Right Time Time Real Estate Investment Strategies™ identify those areas where the socioeconomic indicators are trending upward.

Rick Dryer: Absolutely. We discussed this topic in an earlier conversation. In fact, to illustrate,let’s show the math. Assume you buy a $100,000 property and pay 10% as a down payment. The figures reveal that at a six percent rate of appreciation over 10 years your equity will grow from $10,000 to nearly $90,000. At a 3% rate of appreciation, your equity merely increases to around $44,000. That additional 3% of appreciation doubled the amount of wealth you built up. Now imagine if we’re talking about a $1,000,000 portfolio of rental properties. Over 10 years, that extra margin of appreciation would put an extra one-half million dollars into your pocket. That’s why I emphasize, “First select an area of the country where the signals point towards strong gains in value, then choose your specific property.” An above average rate of appreciation will dramatically enhance the amount of wealth you accumulate over time.

Gary Eldred: I only wish I had followed that principle when I began investing. Why rely on a Model T to get you where you want to go when you could ride in Corvette?

Getting started somewhere clearly beats not getting started at all.

Rick Dryer: You don’t regret buying your first properties in Terre Haute, do you?

Gary Eldred: Not at all. Getting started somewhere clearly beats not getting started at all. And indirectly, that leads to another important point you frequently make. No one can forecast with certainty. So, what happens to your ability to make money if an area doesn’t appreciate as fast as you expect? In fact, what if it doesn’t appreciate at all?

Rick Dryer: What happens? You still make money. Just not nearly as much. As long as your rent collections (over time) cover your expenses and mortgage payments, you’ll build wealth through amortization. Your tenants buy your property for you by paying down your mortgage.

Gary Eldred: As usual, you read my mind. Back in the mid-1990s, I conducted a number of Stop Renting Now® seminars throughout the country—which by the way is also the title of one of the books I have written.

Rick Dryer: It’s still a very useful read.

Gary Eldred: Thank you. Well, back then I told my audiences: “You think you must decide whether to buy or rent. But you’re wrong. You are going to buy—even if you rent. Unfortunately, as renters, you will buy the property for your landlords, not yourselves. The real question is not, rent or buy? It’s rent or own."

Rick Dryer: I guess we landlords are lucky that millions of renters still want to buy our properties for us.

Gary Eldred: That we are.

Rick Dryer: Maybe you should illustrate this idea more thoroughly.

Gary Eldred: Okay. Let’s return to that wonderful fact that when banks see us walk in to borrow money for property, they open their vaults and issue us a check for 80 or 90 percent of our purchase price, based to some degree on our being good economic citizens, but based even more on the reliable value of real estate (the collateral) itself.

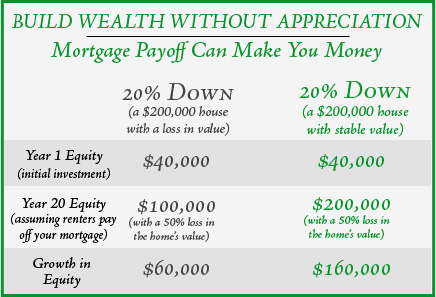

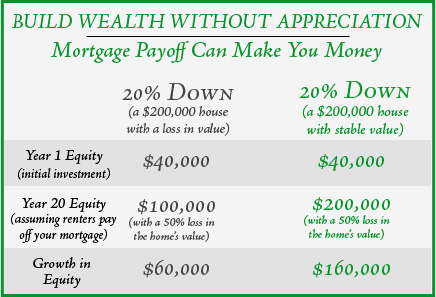

Say you acquire a property that is priced at $200,000. You put up $40,000. The bank contributes $160,000. Over the next 15, 20, or 30 years, your tenants give you the money to repay the bank. Even if you resell that property for $200,000—exactly the same amount as your purchase price—with no remaining mortgage balance—your $40,000 has multiplied fivefold. In fact, if you sold that property for just $100,000, half of your purchase price, you would still receive a 150 percent gain over your original $40,000 down payment!

Admittedly, after accounting for increases in the cost of living, your real gain in purchasing power probably wouldn’t amount to much if you only got back $100,000 after 30 years. Nevertheless, contrary to the “appreciation is everything” contest hyped by the media, you can see that even in those rare instances when property prices stabilize or fall, you can still pocket more cash than you started with. That fact again emphasizes the risk/return advantages of real estate.

Rick Dryer: In my experience, you can’t get that kind of favorable result with any other type of investment.

Gary Eldred: That’s for sure.

Rick Dryer: Gary, let me ask you a question. Do you still own properties in Terre Haute?

Gary Eldred: No, why do you ask? I know you’re going somewhere with that question.

Rick Dryer: Did you sell your properties because you moved away from Indiana?

Gary Eldred: Of course not. You know that I have often owned property that’s located thousands of miles from where I live.

Rick Dryer: So, why did you sell?

Gary Eldred: Okay, I’m catching on now. I sold because I came to see that other areas offered better opportunities—or as you would say, better probabilities—for growth and appreciation.

Rick Dryer: Right. And that illustrates two important points. First, areas do not deteriorate overnight. They go downhill over a period of years and decades. When the growth and potential of an area begins to lag, savvy investors don’t complain, “Gee, I guess I’m stuck. I bought these properties and it certainly looks like they’re in for a long-term decline.” No savvy investors sell their low-potential properties and move their money to more promising locations.

Gary Eldred: Exactly. In today’s world of instant communication and rapid travel, savvy investors don’t just look for diamonds in their own back yard. With all due respect to Russell Conwell, you’re smart to open your eyes to wider horizons.*

Rick Dryer: And that makes a second important point. Due to myopic vision, many people only buy property in the areas where they live. They handcuff themselves to that limited market. For some incredible reason, so called experts often tell their followers, only buy within, say, an hour of your home. But as we have mentioned, you and I have regularly owned real estate thousands of miles from our homes. Sometimes that’s where the best opportunities are available. As a side benefit, different geographic areas also help investors diversify their wealth. Don’t put all of your eggs into one basket remains a valid investment principle.

No longer do competent financial advisors believe the old saw that says, “only buy

properties located within 45 minutes of where you live.”

Gary Eldred: So, we’re really making two related points. First, even if you buy into an area that over the long term fails to experience increased prices—a rare sight indeed—you can still pocket a substantial amount of cash when you sell because you’ve built substantial equity because your tenants have paid off your mortgage for you.

Second, and I think more importantly, you need not commit permanently to any area—at least as it pertains to property investments. Study the economic and demographic indicators, research where they lead you, and you’ll discover abundant emerging growth opportunities. Phoenix and Las Vegas offered strong promise 10 years ago. Now, though, the facts clearly show that those markets are overbuilt and overbought by flippers and speculators. Other areas stand out as better choices for price appreciation.

Phoenix and Las Vegas offered strong promise 10 years ago. Now, though, the facts clearly show that those markets are overbuilt and overbought by flippers and speculators.

Rick Dryer: Think of investing results in terms of probabilities, not merely as a rear view mirror that you erroneously rely on to tell you how to best get to where you want to go. , And certainly, you should not hope for investing results as you would with a kiss-the-dice crap shoot.

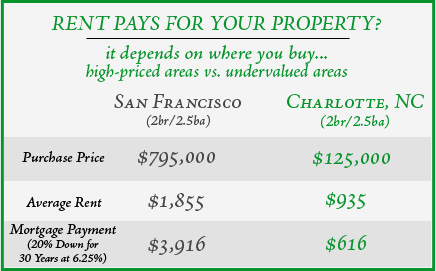

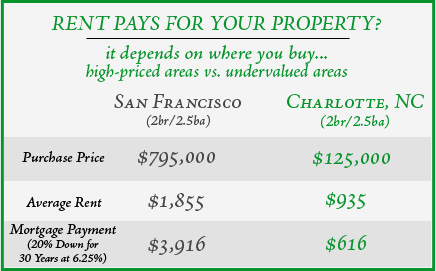

Gary Eldred: Rick, we’ve talked about areas that lack dynamic up indicators—such as Terre Haute, or for that matter, most of the Midwest. How about areas such as San Francisco, Boston, Miami, and New York? These areas show many strong growth indicators and they’ve certainly experienced enviable rates of appreciation.

Rick Dryer: In my view, like Phoenix and Las Vegas, these cities are now “priced to perfection.” Any bump in the road will rattle those markets. They may be great places to live, but they’re no longer great places to invest if you look at the acquisition cost ratios.

Gary Eldred: (laughs) The what kind of ratios? What are they? Aren’t you most excited by areas that have appreciated the most in the past and extrapolate those rates of appreciation into the future?

Rick Dryer: Gary, now you’re pulling my chain.

Gary Eldred: Why, Rick, are you going to bring up that out-dated concept of cash flow relative to acquisition costs as one of your buy signals?

Rick Dryer: (smiles) You know I am. We’ve just talked about how you can build wealth in real estate through amortization (paying off your mortgage with the rents your tenants pay). When reasonable forecasts show that over time you can collect enough rents to cover your operating expenses and monthly mortgage payments, down the road you will own a property free and clear. Yet, you’ve only invested a relatively small amount of your own money. Thank you, tenants. But to make economic sense, rents collections need to cover operating expenses and mortgage payments–not immediately, as those

kinds of properties tend not to appreciate well, but gradually over a foreseeable short-term period of say, 3 to 5 years.

In San Francisco, New York, and other similar high-priced cities, the odds are stacked against that outcome,. In those areas, most single-family rentals bring in a mere 50 percent of the amount necessary to cover cash outflows. Over time, rent increases will cover some of that negative cash flow.Yet, in terms of probabilities, investors in those markets could wait more than a decade for their rent collections to fully catch up to the amount of monthly drain on their cash. It’s quite unlikely that

property appreciation could continue to climb fast enough to make those properties profitable in light of negative cash outflows of thousands of dollars a month.

Gary Eldred: So you think California and New York investors are playing the “greater fool” game? Or as you say, “pricing for perfection?” In fact,my book, Investing In Real Estate illustrates this point for San Francisco using the years 1988 through 1998. “Peak

of the boom” buyers in the late 1980s were still underwater in San Francisco more than

10 years later.

Rick Dryer: I figure that we’re looking at a similar situation today. Maybe those current San Francisco buyers know something that I don’t.

Gary Eldred: Possible, but not likely.

Rick Dryer: Whatever their reasons, I think buyers of properties that show no potential for positive cash flows must prefer to speculate, rather than invest. They fail to distinguish risk from risky.

Gary Eldred: That’s certainly a topic we will want to go into further in later conversations. Risk and risky differ from each other greatly. No real estate is without some risk, but when the cash flows relative to the purchase price looks pathetic, you’re speculating, not investing. As we both know, investors build their wealth on a solid foundation. Speculators—even those who are lucky enough to hit it big (remember all of those high fliers of the late 1990s who thought themselves stock market geniuses)—more often than not, end up losing their fortunes on an ill-placed bet.

<Previous Dialogue | Next Dialogue>

|