Rick Dryer: Gary, your bestselling book, Investing in Real Estate—in fact I think you’ve just come out with a 5th edition, right?

Gary Eldred: Right. Your investing strategies are even cited in it.

Rick Dryer: Great, I’m flattered. Still, Investing in Real Estate—as well as other books that you’ve written—discuss a variety of ways to invest in real estate. For example, you talk about nothing down, flipping, bargain prices, foreclosures, fixer uppers, tax deeds, discounted paper, condo conversions, short sales, lease options, and buy and hold. Which of these techniques do you prefer?

Gary Eldred: Which do I prefer for myself? Or what approach works best for most people who would like to build wealth without much work or risk?

Rick Dryer: Both.

Gary Eldred: As for myself, I like to make money with property anyway I can. My knowledge, experience, cash, and credit pretty much open all doors—if my detailed study of the market and the property point towards a rewarding outcome.

Rick Dryer: You say “knowledge, experience, etc.” Do most techniques really require knowledge, experience, detailed study, money, and credit? Many of the so-called gurus who peddle books, CDs, seminars, boot camps, and coaching—the kind of guys and gals we see on late night cable—tell real estate newbies that they can master some property technique by just following the guru’s easy, foolproof system. “No cash, no credit, no knowledge, no experience, no problem.” The guru often promises a quick and easy road to wealth.

Gary Eldred: Nonsense. Absolute unadulterated nonsense. May I elaborate? In doing so, I will lead up to my advice for most people.

Rick Dryer: As Conrad Hilton says, “Be my guest.”

Gary Eldred: That reminds me, Rick. The Hilton Hotels used to put that book by Mr. Hilton in all of its hotel rooms.

But I was recently at Hilton Hotels in Tokyo, London, and the Newark airport. None provided a copy. They should. Mr. Hilton’s theme fits very well with what we know to be true. Success results from hard work, market knowledge, creative insights, and attention to details.

Rick Dryer: So you think the promoters of nothing down, flipping, lease options, foreclosures, and so on omit the essential principles that most of these property techniques require?

Gary Eldred: Yes, they do. Let me illustrate what I mean.

Rick Dryer: Once again, be my guest.

Gary Eldred: Take the familiar come on, “No cash, no credit, no problem.” Rick, do you remember the twist I gave to that phrase in my Right Place, Right Time Real Estate Investment Properties™ presentations?

Rick Dryer: Sure do. You said, “No cash, no credit, BIG PROBLEM.”

Gary Eldred: Good memory.

Rick Dryer: That one’s easy because it always got a big laugh from the audience. Anyone who’s sentient should readily see that “no cash, no credit” creates a world of hurt for anyone who finds himself in that position.

Gary Eldred: Exactly. To build wealth, you must first practice financial discipline. If you spend and borrow like a drunken sailor—or the U.S. government—you will always work for money and never enjoy the luxury where your money works for you.

Rick Dryer: Have you ever bought properties with little or nothing down?

Gary Eldred: Of course I have. The lower my down payment, the greater the wealth building effect of leverage. I like the banks (or sellers) to finance my properties. But in contrast to guru promises, I never assumed that I could turn those high leverage purchases into instant wealth. I also had reserves of cash and credit that I could draw on should I face an unexpected personal or property expense.

Rick Dryer: That is the most important distinction between those who understand real estate investing and those who are just going to get themselves in trouble. You’re saying, as a first step to building wealth with property, you believe that would-be investors need to spend and borrow below their means, not hoping or pretending that nothing can or ever does go wrong, or take a little longer, or cost a little more, or require a little more reserves?

Gary Eldred: Exactly. Major studies have reviewed the finances of millions of people. The evidence stands undisputed. Middle-income, and even low-income, people who invest regularly build more wealth than much higher income earners who live payday to payday. Living below your means is key.

Rick Dryer: That reminds me of the Thomas Stanley bestseller, The Millionaire Next Door. Stanley proved with real life personal histories that anyone who invests regularly, manages their money, and avoids destructive debt can accumulate millions.

Gary Eldred: Yes, Stanley wrote a book filled with inspiring examples and advice—substance triumphs over flash. There is no instant pudding. That’s one of many reasons we both advocate, “buy and hold”.

Rick Dryer: That is our core belief. Okay, Gary, once someone gets their finances in shape, do you think they can speed down the fast track to wealth with fixers, flippers, foreclosures, or some other exotic money-making technique?

Gary Eldred: No, or at least not usually. First, as we’ve talked about in a previous conversation, ”buy, hold, trade up, refinance” can offer multiple tax benefits. Unfortunately, none of the exotic techniques qualifies to maximize these tax benefits. Instant wealth even if achieved is whacked with taxes The great tax benefits of property mainly apply only to long-term investors. The IRS classifies people who buy and sell for quick profits as dealers. When you deal in properties, the IRS taxes your profits as ordinary income. You do not receive the tax benefits of depreciation, Section 1031 exchanges, or capital gains.

Rick Dryer: But if you earn those fat profit margins the gurus promised, what’s the big deal. As we both agree, Gary, investors should focus on after-tax profits, not tax savings in and of themselves.

Gary Eldred: Unfortunately, those much ballyhooed profit margins don’t come as easy, fat or frequently as many gurus will lead you to believe.

Rick Dryer: You mean that most people can’t really buy foreclosures or tax deeds for pennies on the dollar? Are you saying that one of those motivated sellers I hear so much about won’t really discount their price 30 or 40 percent below market value if I promise to close quickly?

What percent of these millionaires earned their wealth through fixing, flipping, foreclosures, lease options, discounted paper or tax deeds?

I can’t think of anybody who built their wealth through any of these or similar

“infomercial” techniques.

Gary Eldred: Rick, I know this news comes as a big surprise to you. Let me ask you a question. You know personally and have met scores—probably hundreds—of people who have become millionaires from real estate. What percent of these millionaires earned their wealth through fixing, flipping, foreclosures, lease options, discounted paper or tax deeds? 80 percent? 50 percent? 20 percent or 0 percent.

Rick Dryer: Zero percent. I can’t think of anybody who built their wealth through any of these or similar “infomercial” techniques. Can you?

Gary Eldred: Nope, me neither.

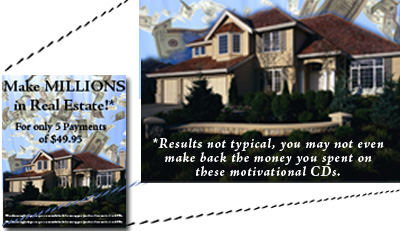

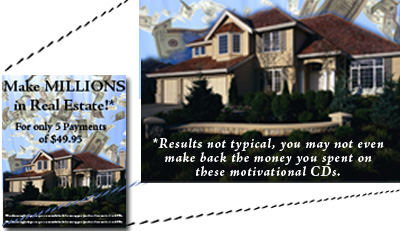

Rick Dryer: Gary, so you’re saying that the promoters of these techniques typically make much more promoting their books, courses, tapes and seminars than their students make following these techniques?

Gary Eldred: Without a doubt. You’ve seen their fine print disclaimers, “results not typical. Your results may differ.”

Rick Dryer: Okay, now let me ask you another question. If experience and common sense say it’s tough to build wealth using these techniques, why do you put them into your books? ‘Cause you know I preach a simpler, 18 principle, buy new at the right time and hold in the right place. Is this a rare Gary-Rick disagreement?

Gary Eldred: You know the difference is more apparent than real. We don’t really disagree. But I inform my readers of these techniques for four reasons good reasons, I think:

First, I believe it necessary to debunk the gurus who promote these techniques. I show why it’s tough to find or execute such deals. I want my readers to realistically understand the time, money,effort, and yes, risks such techniques require.

Second, in my books I try to describe the knowledge, market research, skills, cash, and credit typically necessary to help active investors diminish the risk and increase their potential for profits. Too many potential investors pass by more suitable opportunities in real estate.They waste time and money chasing after the difficult and near impossible.

They then give up on “real estate” without actually giving the most proven technique of buy and hold a try.

Third, every now and then you do run across a truly great fix and flip, foreclosure, or similar possibilities. Although most investors should not spend much time ferreting out these kind of deals, they should remain alert and know how to evaluate such opportunities that may come their way. Even blind pigs are entitled to an occasional acorn.

Fourth, , although I do not recommend it, some people want to quit their day jobs and go into property investing full time. These people represent that small number who try to substitute the profits they hope to earn from real estate for the monthly paycheck they previously received from their job. These are the people who dream of saying to their boss, “Take this job and shove it.” So, even asuming the talent and realistic expectations necessary to make these techniques work, I show my readers, it is W-O-R-K. You may get a great result, but you will be working for it. Rick, you emphasize that real estate should work for its owners, not the other way around, and I agree-- for most people, most of the time. But for the reasons I mention above, I would rather investors get the straight talk from me than fall for false promises quite often delivered through ove rpriced seminars, boot camps, coaching come-ons, and CD programs/workbooks. I know of many people who have paid more for false promises than a down payment on a good buy and hold property. rpriced seminars, boot camps, coaching come-ons, and CD programs/workbooks. I know of many people who have paid more for false promises than a down payment on a good buy and hold property.

Rick Dryer: Okay, knowledge is power. I agree. But Gary, why do you advise most people not to quit their day jobs?

Gary Eldred: Their monthly paycheck gives them borrowing power. Their monthly paycheck provides for everyday living expenses. If they try to live on their property profits, they will not stand much chance of building wealth.

Rick Dryer: Gary, you’ve pretty much captured what I’ve found to be true for many years. The property investors who build the most wealth are those that follow a long-term buy, hold, buy more investment strategy. They decide what to buy and how to do it by studying market facts and the probabilities for rewarding outcomes.

Gary Eldred: That’s how I’ve written the conclusion for every edition of Investing in Real Estate. If over a number of years, you acquire just five or ten rental houses, I believe you will build more wealth, more certainly than is possible through any other type of investment or investment technique. With good management in place, your rental houses will require minimal time and effort.

Rick Dryer: Quite right. For the most profitable results, just be sure to choose the right place, right time areas in which to to invest. Through amortization and appreciation you’ll grow acorns (small down payments) into oak trees (an equity position that is 50, 100, 200 times greater than the amount of your original investment.

Gary Eldred: I like that metaphor. It not only envisions the heights to which an investor can grow his or her wealth, it also captures the fact that wealth will be anchored by

strong, durable roots.

Rick Dryer: Amen.

|

rpriced seminars, boot camps, coaching come-ons, and CD programs/workbooks. I know of many people who have paid more for false promises than a down payment on a good buy and hold property.

rpriced seminars, boot camps, coaching come-ons, and CD programs/workbooks. I know of many people who have paid more for false promises than a down payment on a good buy and hold property.